About Us

Empowering Business Excellence: Discover the Gassó Difference

"Gasso Capital Markets recognizes that the majority of the industries we engage in are all global in nature and understanding the unique aspects of each industry from a broader perspective brings superior value to our clients. Our global view and advice is valued by our clients in today’s dynamic world markets."

Hector J. Cuellar

President & Managing Partner (US)

Connecting Europe & the Americas

Gassó Capital Markets is a boutique investment banking firm staffed by a highly experienced team with wide ranging US domestic and cross-border experience. Established by Hector J. Cuellar, the former President of award-winning US investment banking firm, McGladrey Capital Markets, this new platform was established in 2012 to focus on cross-border M&A transactions between Europe and the Americas. Gassó Capital Markets provides tailored advisory solutions, with a focus on mergers, acquisitions, corporate divestitures, and capital raising services to major corporations, private equity groups, and family offices. Our clients are assured of high-level attention, in-depth industry knowledge, tailored solutions, discretion and seamless execution. This combined expertise allows us to offer innovative and comprehensive solutions to help our clients realize their global objectives. Gassó Capital Markets is committed to serving our clients regardless of location and has resources in the US and in Europe.

Industry Relationships

Gassó Capital Markets’ team have successfully closed transactions in every sector of the industry spectrum. We can quickly gain an understanding of our clients’ industries, the markets they serve and their competitive position to ultimately maximize value.

Completed Transactions

Collectively Gassó Capital Markets’ dealmakers have over 50 years of investment banking experience so our list of completed transactions is extensive. The following deals have therefore been selected to highlight our industry and global coverage though these represent a mere fraction of the many deals we have successfully closed over the years.

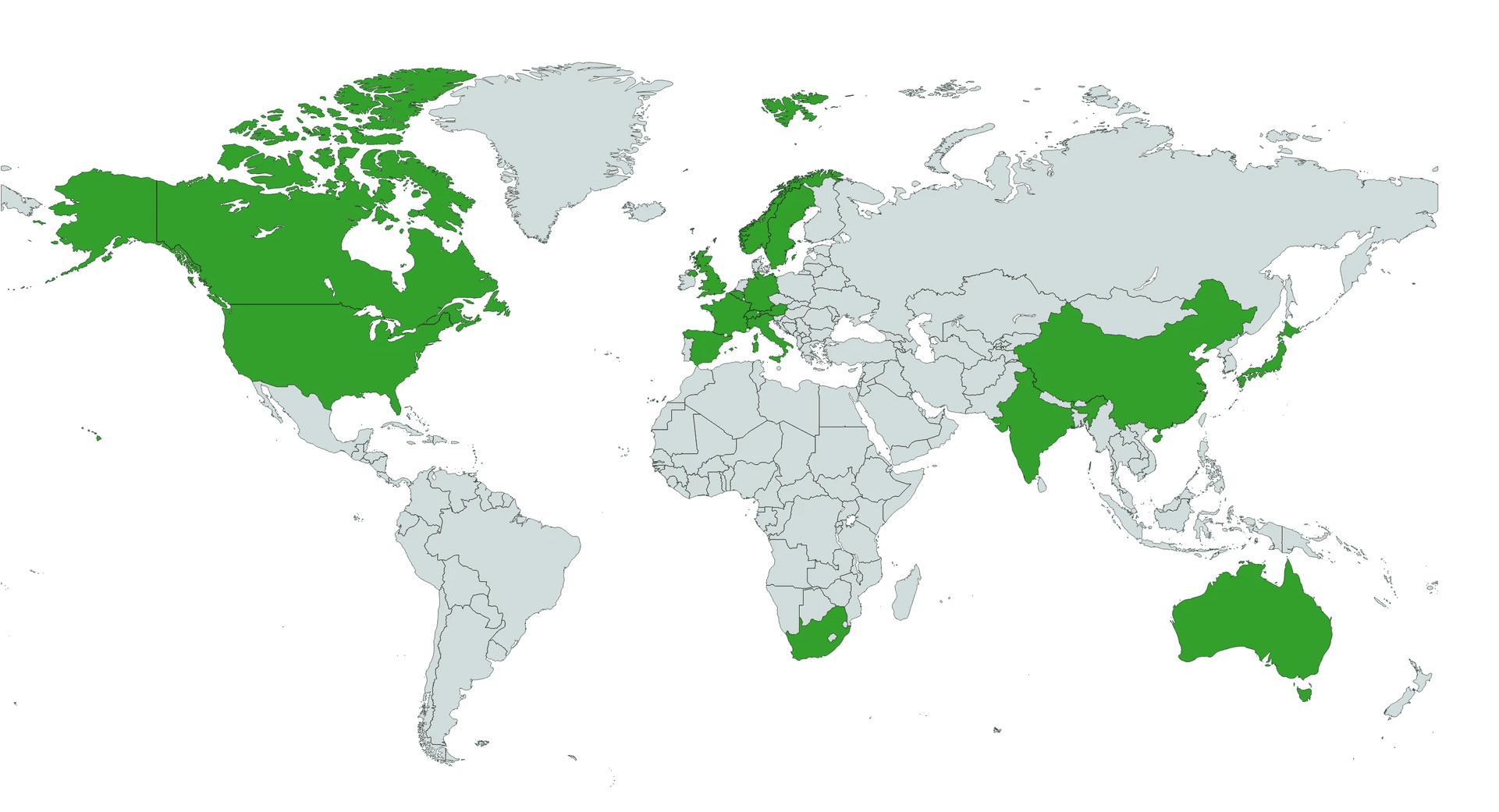

Geographic Reach

Gassó Capital Markets has a proven ability to unearth the unlikely buyer. While our strength is in North America and Europe, we have a global network to draw upon.

Our team has successfully concluded deals with companies in almost every corner of the world as shown in the map below. These countries include: US, Canada, UK, Spain, France, Italy, Switzerland, Germany, Belgium, Austria, Norway, Sweden, South Africa, India, China, Japan and Australia.